Car repair and maintenance

Increasing sales and EBITDA in the car trade is easier than ever before. Car dealerships stay in control throughout the lifecycle of the customer relationship by providing car service financing through the Lendiro platform

SOLUTIONS / CAR TRADE AND MAINTENANCE

Increase sales by financing car maintenance from your own balance sheet

Growth targets are difficult to achieve in a challenging market environment. For example, growth in sales and EBITDA should be at least partly achieved from the existing customer base. But how?

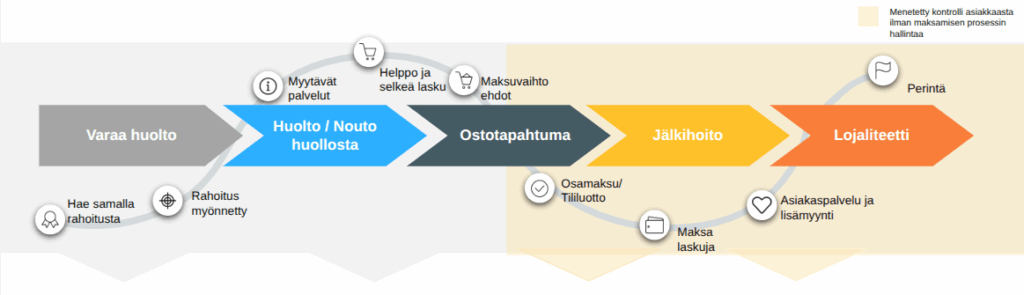

By integrating the Lendiron system into your purchasing process, you can provide car maintenance from your own balance sheet. Financing is automated and the financed customer has access to an online service for loan management.

In addition to the Lendiron system, you can also maintain other financing options.

Comprehensive service

We provide a complete solution including a backend interface and the necessary online services for the end customer.

More revenue from costs and interest

Profitability in the retail sector is falling and it is challenging to increase sales margins. Did you know that the BNPL payment method has an average 3.8% higher EBITDA?

Efficient and secure

Your customers' data is safe in a modern system and with correctly formed and signed credit agreements, you ensure your legal rights.

How does it work?

System features

Here are some of the key features of the system

Why a dedicated financial product?