Financial systems

Profitability in decline? How to achieve a 5% increase in EBITD? Have you considered that by offering self-financing to your customers, you can improve margins and extend customer relationships? Your satisfied customers will also buy more!

SOLUTIONS / FINANCIAL SYSTEM

Different options for offering a financing payment method

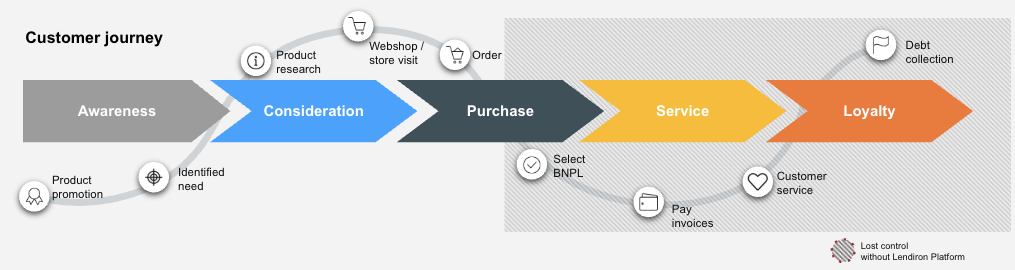

The most traditional way to offer credit to your customers is to partner with a finance company. For most people, that's good enough, but then 95% of the lifecycle of the relationship is handled by the finance company, not the merchant.

Instalment payments from financial companies are one of the most popular payment methods. At the same time, they have become the most expensive payment method for merchants and customers' problems with financial companies are accumulating on the merchant's shoulders.

Lendiron offers a solution to the problem! A financing system that allows you to finance your own customers' purchases and at the same time connect multiple financing partners to enable higher approval rates.

Simplified checkout process

Once you have a customer creating a shopping cart it is financially significant to complete the process. We offer the entire process directly on the merchant's terms without leaving the online store.

My financial products

You can easily build a range of loan products, from short-term loans to revolving overdrafts. There is sure to be a suitable way for your customer to pay!

More revenue from costs and interest

Profitability in the retail sector is falling and it is challenging to increase sales margins. Did you know that the BNPL payment method has an average 3.8% higher EBITDA?

Efficient and secure

Your customers' data is safe in a modern system and with correctly formed and signed credit agreements, you ensure your legal rights.

Features of the lending and financing module

Here are some of the key features

Why a dedicated financial product?